Is your Windsor home properly protected? Review this 7-point insurance checklist covering basement flooding subsidies, overland water coverage, and replacement costs.

Expert Strategy Summary

Quick Summary for Homeowners

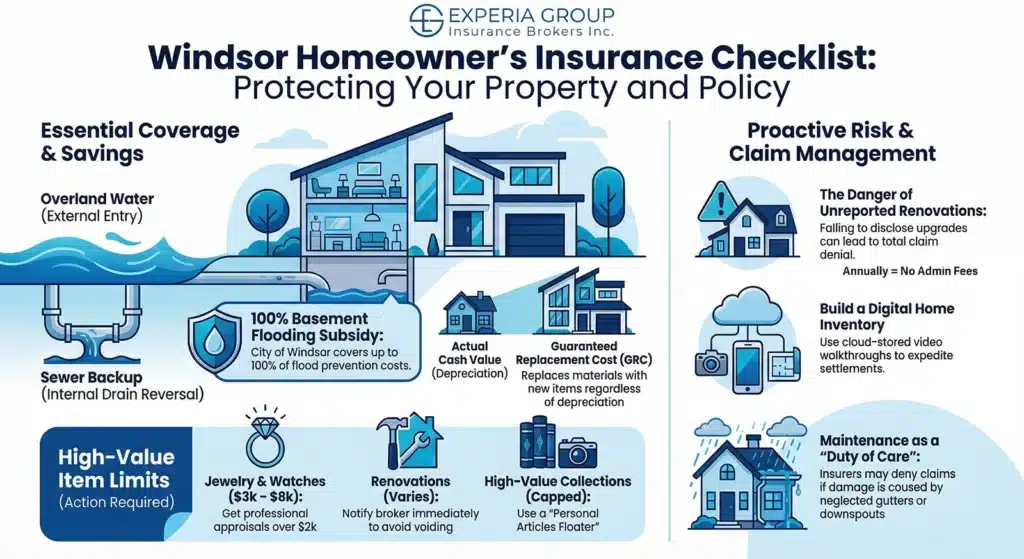

- Maximize Flood Protection: Leverage the City of Windsor’s subsidy program for up to 100% coverage on sump pumps.

- Avoid Coverage Gaps: Distinguish between ‘Guaranteed Replacement Cost’ and ‘Actual Cash Value’ to protect your financial future.

- Renovation Alerts: Learn why failing to report a finished basement or new deck could void your entire policy.

- Inventory Essentials: Discover how a digital home inventory expedites claims for theft or fire damage.

Lower insurance costs usually come from smarter decisions over time, not cutting corners.

1. Distinguish Between Overland Water and Sewer Backup

Windsor’s Unique Water Risks

Given the region’s topography, verifying if your neighbourhood is in a designated flood plain is essential to determining your specific “Overland Water” coverage needs. Current risk assessment data confirms that understanding these local risk factors is the first step in securing a policy that actually performs when disaster strikes.

Defining the Coverage Types

- Overland Water Coverage: Protects against fresh water entering from outside the home (e.g., spring thaw, overflowing rivers, or heavy rain accumulation).

- Sewer Backup Coverage: Protects against wastewater reversing into the home through drains, toilets, or sump pits.

Without specific endorsements for both, a standard policy may leave a Windsor homeowner paying out-of-pocket for tens of thousands of dollars in restoration costs.

2. Leverage the City of Windsor Basement Flooding Protection Subsidy

Government Support for Mitigation

One of the most overlooked opportunities for Windsor homeowners is the municipal support available for flood prevention. The City of Windsor offers a Basement Flooding Protection Subsidy that can cover up to 100% of the cost for installing sump pumps and backwater valves (subject to program limits). This program is designed to harden local infrastructure against the intense storms frequent in Southern Ontario.

Why This Matters for Insurance

- Reduced Premiums: Many insurers offer discounts for homes equipped with professional flood mitigation devices.

- Claim Prevention: A backwater valve automatically closes if sewage attempts to back up into your home, preventing the loss before it happens.

- Eligibility: To qualify, the work generally must be performed by a licensed plumber and inspected by the city.

3. Confirm Guaranteed Replacement Cost vs. Actual Cash Value

The Depreciation Trap

For owners of older properties in areas like Walkerville or Sandwich, the distinction between settlement options is critical. Standard policy wordings highlight that “Actual Cash Value” (ACV) policies deduct depreciation from your payout. If a 20-year-old roof is destroyed, ACV pays only for the remaining lifespan of that roof, not the cost of a new one.

Why Guaranteed Replacement Cost (GRC) is Superior

- New for Old: GRC ensures that materials are replaced with new items of like kind and quality, without deduction for age or wear.

- Inflation Protection: GRC accounts for sudden spikes in construction material and labour costs following a wide-scale regional disaster.

- Policy Requirement: Homeowners must typically insure the home for 100% of its calculated replacement value to qualify for this endorsement.

4. Verify Coverage Limits for High-Value Items

Standard Sub-Limits

Most policies contain strict caps on specific categories of personal property, such as jewelry, bicycles, coin collections, or software. At Experia, we advise reviewing these specific coverage limits, as high-value items are often capped at amounts far lower than their replacement cost (e.g., $3,000 to $6,000 total for all jewelry).

Scheduling Personal Articles

To ensure full protection, a “Personal Articles Floater” or specific endorsement is required. Consider these steps:

- Appraisals: Obtain professional appraisals for items exceeding $2,000 in value.

- Itemization: List items individually on the policy rather than relying on the blanket personal property limit.

- Mysterious Disappearance: Scheduling items often adds coverage for loss types not covered by standard policies, such as losing a ring while gardening.

5. Disclose All Renovations Immediately

The Voiding Risk

Failing to notify your insurer about major upgrades can lead to a denial of coverage. We warn clients that unreported renovations—such as finishing a basement or adding a new deck—can invalidate a home insurance policy. The insurer calculates risk based on the home’s description at issuance; changing that description without notice breaches the contract.

Renovation Checklist

Notify your broker if you plan to:

- Finish a Basement: Increases the replacement cost and water damage exposure.

- Upgrade Electrical/Plumbing: May actually lower premiums if replacing knob-and-tube wiring or galvanized pipes.

- Install a Pool: Significantly alters liability risk profiles.

- Vacate During Construction: If the home is empty for more than 30 days, a vacancy permit is strictly required.

6. Implement Seasonal Maintenance to Protect Claims

Duty of Care

Insurance policies require the homeowner to maintain the property in good repair. Negligence can be grounds for claim denial. Property management experts emphasize the importance of cleaning gutters and downspouts seasonally to prevent water backup claims, a common issue during Windsor-Essex springs.

Discounts for Disaster Resistance

Proactive maintenance and upgrades not only secure claims but also reduce costs. The FSRAO suggests checking for discounts on “disaster resistant” improvements, such as:

- Monitored Alarms: Fire and burglary systems connected to a central station.

- New Roofing: Hail-resistant materials may qualify for rate reductions.

- Tankless Water Heaters: Reducing the risk of large-volume leaks.

7. Create a Digital Home Inventory

Expediting the Claims Process

In the aftermath of a fire or theft, recalling every possession is nearly impossible. The Government of Canada recommends creating a detailed “Home Inventory” list, complete with photos and receipts. This documentation is the single most effective tool for ensuring a fair and fast settlement.

Best Practices for Inventory

- Video Walkthrough: Open every drawer and closet while recording a video on a smartphone. Narrate what you see.

- Cloud Storage: Store the digital files off-site (e.g., Google Drive, iCloud) so they are accessible even if the computer is destroyed.

- Updates: Review the inventory annually or after major purchases like electronics or furniture.

Secure Your Windsor Property with Confidence

Windsor’s weather patterns and unique geography demand a rigorous approach to home insurance. By systematically verifying these seven points—from ensuring Overland Water coverage to documenting assets via a digital inventory—homeowners can shift from passive policyholders to active risk managers. Do not wait for a basement flood or a denied claim to discover the gaps in your protection. Initiate a policy review today, leverage municipal subsidies for backwater valves, and ensure your coverage evolves alongside your home renovations.