Modern product liability claims are reshaping the Canadian insurance landscape. Discover 5 hard truths about rising class actions, settlement costs, and 2026 market volatility.

Strategy Summary

Quick Summary on Liability Trends

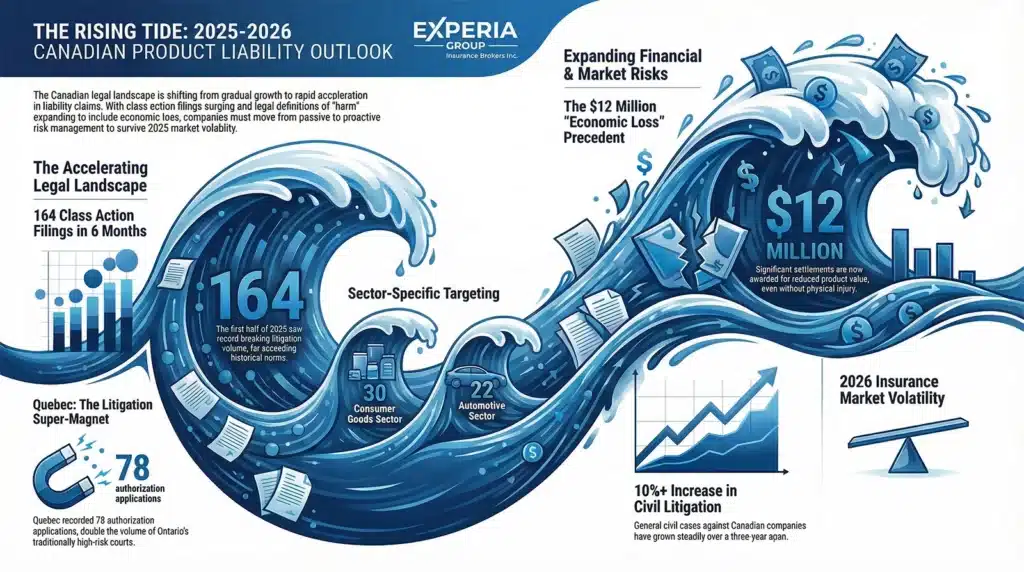

- Exploding Class Actions: Canadian courts saw 164 proposed class actions filed in the first half of 2025 alone.

- Jurisdictional Hotspots: Quebec filed 78 class action authorizations in mid-2025, double the volume of Ontario.

- Rising Settlement Floors: Economic loss claims are driving payouts, evidenced by a recent $12 million vehicle defect settlement.

- Insurance Volatility: 2026 general liability rates are fluctuating between -10% and +5% as insurers adjust to market unpredictability.

Lower insurance costs usually come from smarter decisions over time, not cutting corners.

1. The Volume of Canadian Civil Litigation Has Accelerated

The trajectory of liability claims in Canada has shifted from gradual growth to rapid acceleration. For manufacturers and distributors, the probability of facing litigation is no longer a statistical anomaly but a predictable operational risk. Recent data indicates a systemic rise in legal aggression against commercial entities.

The Surge in Class Action Filings

The first half of 2025 marked a significant turning point in the frequency of mass litigation. According to data from Torys LLP, there were 164 total proposed class actions filed across leading Canadian jurisdictions in just the first six months of the year. This volume suggests a pace that far exceeds historical norms, placing immense pressure on corporate legal defense budgets.

Furthermore, this is not an isolated spike. Broader industry research highlights a wider trend, noting a 10%+ increase in civil litigation cases against Canadian companies over a recent three-year span.

2. Automotive and Consumer Goods Are Prime Targets

While liability risks exist across all industries, the data reveals a concentrated assault on specific sectors. Manufacturers in the automotive and consumer goods spaces are facing a disproportionate share of legal filings, driven by increased regulatory scrutiny and consumer awareness.

Sector-Specific Filing Data

The focus on product defects has sharpened. Torys LLP reports the following breakdown for early 2025:

- Automotive Sector: 22 class-action filings were recorded in the first half of 2025 alone, indicating a high-risk environment for vehicle manufacturers and parts suppliers.

- Consumer Sector: 30 class-action filings specifically targeted consumer goods, often centering on product safety and labeling issues.

These figures demonstrate that product-heavy industries must adopt more rigorous quality assurance and risk transfer strategies to survive the current legal climate.

3. Quebec Has Emerged as a Litigation Super-Magnet

A critical, often overlooked truth in modern product liability is the disparity in risk between provinces. Jurisdiction shopping—where plaintiffs file in courts perceived as more favorable—is reshaping defense strategies. Quebec has solidified its position as the most active jurisdiction for class action authorizations.

The Quebec vs. Ontario Divide

The statistical gap between provinces is widening. In mid-2025, Torys LLP noted that 78 class action authorization applications were filed in Quebec. This figure is double the volume of Ontario, traditionally seen as the center of Canadian corporate litigation.

Implications for National Distributors:

- Increased Defense Costs: Operating in Quebec requires specialized legal counsel familiar with the Civil Code of Quebec, often driving up defense costs.

- Lower Authorization Thresholds: The procedural bar for certifying a class action in Quebec differs from common law provinces, often allowing cases to proceed more easily.

- National Reach: A authorization in Quebec can frequently set the precedent for national settlements.

4. Economic Loss Settlements Are Setting New Precedents

Traditionally, product liability claims hinged on physical injury or property damage. However, the definition of compensable harm is expanding. Courts are increasingly approving significant settlements for “economic loss”—essentially, the loss of value or utility of a product, even in the absence of a catastrophic failure or injury.

The $12 Million Benchmark

A stark example of this shift is highlighted by McCarthy Tétrault, reporting on a $12 million court-approved settlement for economic loss in a single Canadian vehicle defect class action. This case underscores a hard truth for manufacturers: a product does not need to hurt someone to cost the company millions. Allegations of inherent defects that reduce resale value or performance are sufficient to drive massive settlements.

5. Insurance Rate Stability is a Myth for 2026

The cumulative effect of rising litigation volume, sector targeting, jurisdictional risk, and expanded liability definitions is market volatility. Businesses looking for flat renewals in their general liability policies may be disappointed as insurers react to these external pressures.

Forecasting the 2026 Market

Insurers are struggling to price these risks accurately. Global market forecasts predict a rate range of -10% to +5% for 2026 Canadian general liability insurance.

Navigating the 2026 Liability Landscape

The data paints a clear picture: the cost of doing business in Canada involves an increasingly expensive liability burden. With 164 class actions filed in a single half-year and settlement values for economic loss reaching the millions, passive risk management is no longer sufficient. Companies must audit their exposure to Quebec-based filings, brace for volatility in the 2026 insurance renewal cycle, and recognize that the definition of a “defective product” continues to expand in favor of the plaintiff.

Secure Your Manufacturing Operations

As the liability landscape shifts, relying on generic coverage is a risk your bottom line cannot afford. You need a partner who understands the intricacies of the manufacturing sector—from Quebec’s unique legal environment to the rising tide of economic loss claims. Ensure your business is fortified against 2026’s volatility with a strategy built for resilience. For expert guidance and specialized coverage options designed to protect your assets, visit our manufacturing insurance page.